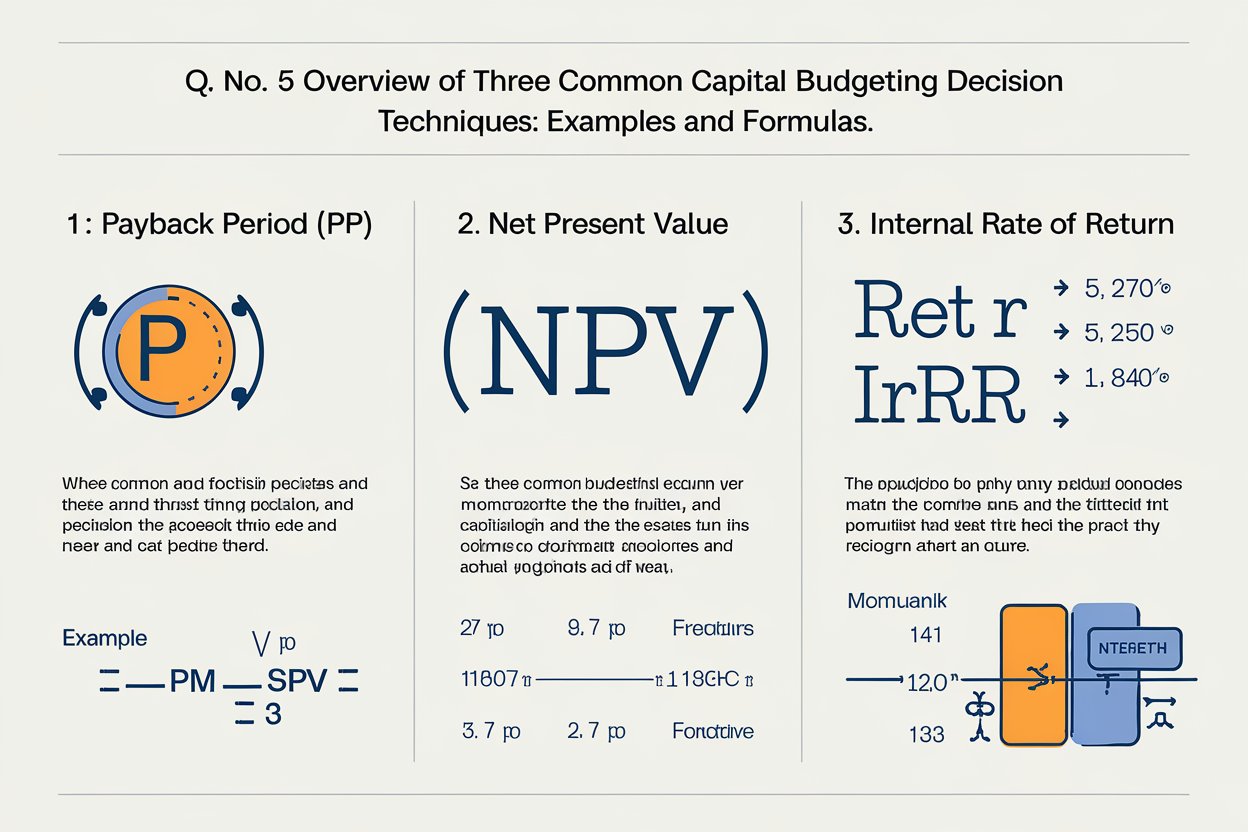

Q. No. 5 Overview of Three Common Capital Budgeting Decision Techniques: Examples and Formulas.

Three Common Capital Budgeting Decision Techniques: Examples and Formulas

Capital budgeting refers to the process of evaluating and selecting long-term investments that are aligned with the strategic goals of an organization. The decision-making process often involves assessing the potential profitability of projects or investments. Below are three commonly used capital budgeting decision techniques:

Advantages:

- Considers the time value of money.

- Provides a clear indication of whether the project adds value.

Disadvantages:

- Depends on an accurate estimate of the discount rate.

- Can be difficult to interpret for projects with irregular cash flows.

2. Internal Rate of Return (IRR)

IRR is the discount rate at which the NPV of an investment is zero. It represents the rate of return at which the present value of future cash inflows equals the initial investment.

Example:

Using the same investment example as above ($50,000 investment generating $20,000 annually for 4 years), you would find the rate that makes the NPV equal to 0. This is often calculated using software like Excel or financial calculators.

Advantages:

- Easy to interpret as a percentage return.

- Accounts for the time value of money.

Disadvantages:

- Can give misleading results for projects with non-conventional cash flows.

- May lead to incorrect decisions when comparing mutually exclusive projects.

3. Payback Period

The payback period measures the time required to recover the initial investment from the cash inflows generated by the project. It is a simple technique that provides the time frame in which an investment pays for itself.

Advantages:

- Simple and easy to calculate.

- Useful for projects that require quick liquidity.

Disadvantages:

- Ignores the time value of money.

- Does not account for cash inflows beyond the payback period.

Conclusion

Each capital budgeting technique—NPV, IRR, and Payback Period—offers distinct advantages and is suited for different types of investment decisions. While NPV and IRR consider the time value of money and are widely used for assessing long-term projects, the payback period is useful for businesses that prioritize liquidity and risk management.