Introduction to Monopolistic Market Structure

Monopolistic market structure is characterized by a single firm having control over the production and pricing of a particular product or service, with limited or no close substitutes available to consumers. Unlike perfect competition where numerous firms produce identical goods, or monopoly where a single firm dominates the market entirely, monopolistic competition lies somewhere in between.In a monopolistic market structure, firms have the ability to differentiate their products through branding, advertising, and product differentiation. This differentiation creates a degree of market power, allowing firms to set prices above marginal cost without losing all their customers to competitors. However, because there are still substitutes available, firms cannot set prices arbitrarily high. One key feature of monopolistic competition is that firms face a downward-sloping demand curve for their products. This means that as they increase the quantity they produce and sell, they must lower the price to entice consumers to purchase more. This contrasts with perfect competition, where firms face a perfectly elastic demand curve at the market price. In monopolistic competition, each firm has some degree of monopoly power over its unique product or brand. This allows them to engage in non-price competition, such as advertising and product differentiation, to capture market share and maintain their profit margins. However, this also leads to inefficiencies, as firms may engage in wasteful spending on advertising or unnecessary product differentiation to differentiate themselves from competitors. Overall, monopolistic market structures represent a middle ground between perfect competition and monopoly, where firms have some degree of market power but face competition from close substitutes. This competition encourages innovation and product differentiation, but may also lead to inefficiencies and higher prices for consumers compared to perfect competition.

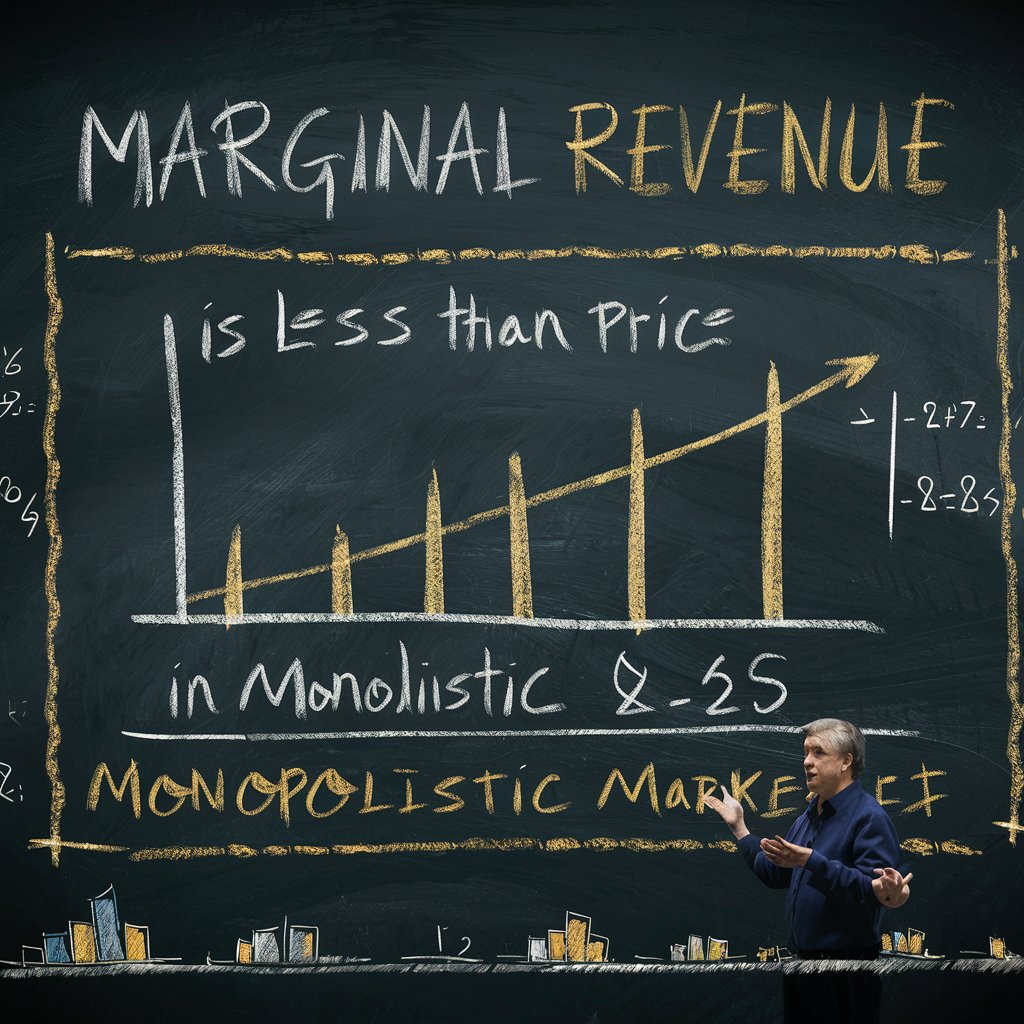

Concept of Marginal Revenue:

Marginal revenue (MR) is a fundamental concept in microeconomics that measures the change in total revenue resulting from the sale of one additional unit of a product or service. It is a critical metric for firms as it helps them make decisions regarding pricing and production levels. Mathematically, marginal revenue is derived from the total revenue function with respect to quantity. It represents the slope of the total revenue curve and is calculated as the derivative of total revenue with respect to quantity. In simple terms, it answers the question: “How much additional revenue will be generated by selling one more unit of the product?” Understanding marginal revenue is crucial for profit maximization. In competitive markets, where firms are price takers, marginal revenue is equal to the market price since selling additional units does not affect the price. However, in monopolistic or imperfectly competitive markets, such as monopolies or monopolistic competition, marginal revenue differs from the price due to the firm’s ability to influence market conditions. In monopolistic markets, firms face a downward-sloping demand curve because they have market power, meaning they can set prices above marginal cost. Consequently, to sell more units, firms must lower prices, which leads to a decrease in marginal revenue. This is because each additional unit sold not only brings in revenue equal to the new price but also reduces the price received for all units sold, resulting in less incremental revenue. Graphically, marginal revenue is typically depicted as a curve that lies below the demand curve. This relationship highlights the fact that marginal revenue is less than the price in monopolistic markets. Therefore, firms must carefully consider marginal revenue when determining their optimal level of output and pricing strategy to maximize profits. In summary, marginal revenue is a vital concept in microeconomics that measures the change in total revenue resulting from selling one additional unit of a product or service. It plays a central role in profit maximization decisions for firms, particularly in monopolistic or imperfectly competitive markets where firms have the ability to influence prices.

Derivation of Marginal Revenue Formula:

The derivation of the marginal revenue (MR) concept involves understanding how a change in the quantity sold affects the total revenue earned by a firm. Marginal revenue represents the additional revenue gained from selling one more unit of a product.

Imagine a scenario where a firm sells a certain quantity of its product at a specific price. The total revenue generated from these sales represents the firm’s current income level. Now, if the firm decides to sell one more unit of the product, the total revenue will increase due to the revenue earned from selling this extra unit. This increase in total revenue is the marginal revenue.

In essence, marginal revenue measures the incremental change in total revenue resulting from the sale of one additional unit of the product. It is crucial for firms to understand this concept as it helps them make decisions regarding pricing and production levels to maximize profits.

For instance, if a firm finds that its marginal revenue exceeds its marginal cost, it may consider increasing production to capture additional profits. Conversely, if marginal revenue is less than marginal cost, the firm might decrease production to avoid losses.

By intuitively grasping the relationship between changes in quantity sold and total revenue, firms can make informed decisions about their pricing strategies and production levels, ultimately aiming to optimize their profits. This understanding of marginal revenue is fundamental in microeconomic analysis and is applicable across various market structures, guiding firms in their quest for profitability and sustainability.

Relationship between Marginal Revenue and Price:

The relationship between marginal revenue (MR) and price is fundamental in understanding how firms operate and make decisions regarding pricing and production levels. In various market structures, such as perfect competition, monopolistic competition, monopoly, or oligopoly, this relationship can differ significantly, influencing the firm’s behavior and profit maximization strategies.

- Perfect Competition:

- In perfect competition, where there are many small firms selling homogeneous products and no individual firm has control over the market price, the price (P) is constant and equal to marginal revenue (MR). This is because each firm is a price taker and can sell any quantity of output at the prevailing market price.

- Mathematically, indicating that the marginal revenue curve coincides with the demand curve, which is perfectly elastic.

- Monopoly:

- In a monopoly, where there is only one seller controlling the entire market, the firm faces a downward-sloping demand curve. As the monopolist increases the quantity sold, it must lower the price to attract more customers. Consequently, marginal revenue is less than price (MR < P).

- Mathematically, highlighting the inverse relationship between marginal revenue and price in a monopolistic market structure. This relationship arises because the monopolist can only sell more units by lowering the price for all units sold.

- Monopolistic Competition:

- In monopolistic competition, firms differentiate their products through branding, advertising, or product features, giving them some degree of market power. As a result, they face a downward-sloping demand curve.

- Similar to monopoly, marginal revenue is less than price in monopolistic competition (MR < P). Firms must lower prices to sell more units, leading to a decrease in marginal revenue.

- Oligopoly:

- In oligopoly, where a few large firms dominate the market, the relationship between marginal revenue and price can vary depending on the behavior of the firms. If firms collude and act as a cartel, they may collectively set prices above marginal cost, resulting in marginal revenue being less than price. However, if firms compete aggressively, the relationship may resemble that of monopolistic competition or even perfect competition.

In summary, the relationship between marginal revenue and price varies across different market structures. While in perfect competition, they are equal, in monopolistic and oligopolistic markets, marginal revenue is typically less than price due to the firm’s ability to influence market conditions. Understanding this relationship is crucial for firms to optimize their pricing and output decisions and maximize profits.

Conclusion: Marginal Revenue vs. Price in Monopolistic Markets

In monopolistic markets, the relationship between marginal revenue (MR) and price is characterized by MR being less than price. This fundamental conclusion arises due to the monopolistic firm’s ability to influence market conditions, particularly through product differentiation and brand identity.

When a firm in a monopolistic market reduces the price to sell more units, it must lower the price not just for the additional unit but for all units sold. This is because the firm faces a downward-sloping demand curve, where consumers are willing to buy more units only if the price decreases. As a result, the marginal revenue generated from selling an additional unit is less than the price.

Mathematically, this relationship is expressed where MR represents the change in total revenue resulting from selling one additional unit, and P represents the price. The marginal revenue curve lies below the demand curve, illustrating that to sell more units, the firm must accept a lower price for each unit sold.

This conclusion has significant implications for monopolistic firms. It indicates that to maximize profits, firms should continue producing until marginal revenue equals marginal cost, not until price equals marginal cost, as would be the case in perfect competition. By understanding the relationship between marginal revenue and price, monopolistic firms can make informed decisions about pricing strategies and production levels to optimize their profits in the market.